Anyone catch headlines about the recent Netflix earnings call? Pretty tame this time around, right…? I DON’T THINK SO! Unless you’ve been living under a professional rock (or taken a holiday with your work email actually turned off, in which case go you, set those boundaries!) you might, might, might have read about Netflix’s Terrible, Horrible, No Good, Very Bad Day.

SUBSCRIBER LOSS!!!… for the first time in a decade. Driven by the pullout from Russia, though, more significantly, also driven by genuine softening in the U.S. (where they introduced a price hike).

CRACKDOWN ON ACCOUNT SHARING!!!… with the service estimating as many as 100 million households using via password sharing. That’s more than 30% of their userbase.

ADVERTISING!!!… No, not as standard in your current subscription plan, despite what some news outlets would suggest. A separate tier coming at some point in the future.

Takes are going like hotcakes. Horror leads the headlines as we all watch Netflix’s stock price implode. Call me naïve, but I’ve never understood why it’s so outrageous to see something that went up, come down. Matthew Belloni at Puck News issued a cool dissection of the relationship between Netflix, Hollywood, and Wall Street, which I found to be a refreshing counter to the generalized hysteria.

Trouble at Netflix Family Animation

Amongst the chaos, TheWrap dropped a blistering dispatch about Netflix Animation, which I would highlight as THE read right now for anyone working in the kids and family content space. After the honeymoon period, which saw Netflix cherry-pick creators from major studios, the experience for many seems to have soured. Problems reportedly include mixed messages, algorithm impotence, fudgy data, hand-shackled marketing, and distribution incarceration.

A “thesis” evolution from:

“We want to be the home of everybody’s favorite show”

to

“We want to make what our audience wants to see”

speaks to the significant shift in commissioning strategy. This leaves Netflix with a bit of an identity crisis, particularly since there was a clear focus on greenlighting cutting-edge series within the medium of animation, and the genre of kids, for years. Shows like City of Ghosts and Centaurworld were always going to take nurturing to find an audience, no matter the network.

City of Ghosts – Picture: Netflix

This comes a month after a very candid interview with Rachel Shukert, series creator of Netflix Original The Baby-Sitters Club, which covered similar ground. The “binge-ability index,” which seems to be a core Netflix priority, will always play differently for kids series. Success here probably looks more like sitcom consumption—comfort viewing where the per episode repeat factor is out of this world.

Unfortunately, by nature, publicly released Netflix metrics will struggle to really tell this story. The company’s Global Top 10 lists are a masterclass in obfuscation. A bamboozle of data, with just enough granularity to prevent any sort of comprehensive view of the picture. Nevertheless, we (I!) persevere in painting some context on a complicated canvas.

Netflix Kids Series Performance in Q1 2022

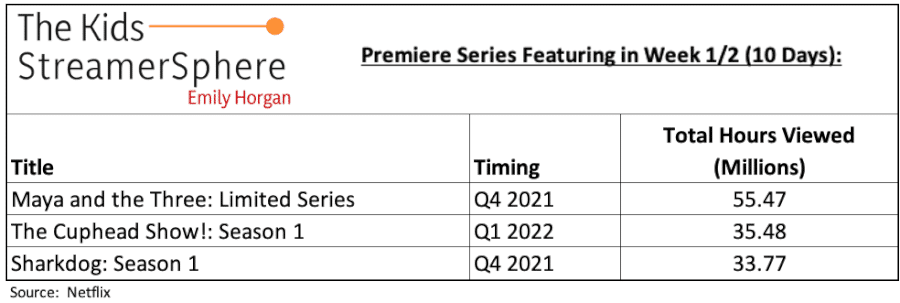

Sticking with series, content performance for Q1 saw engagement with precisely the type of show Netflix has been known for. The Cuphead Show! follows quirky characters, in a vintage animation style, and is the first kids series to hit three weeks of the Global Top 10s with 47.29m hours viewed.

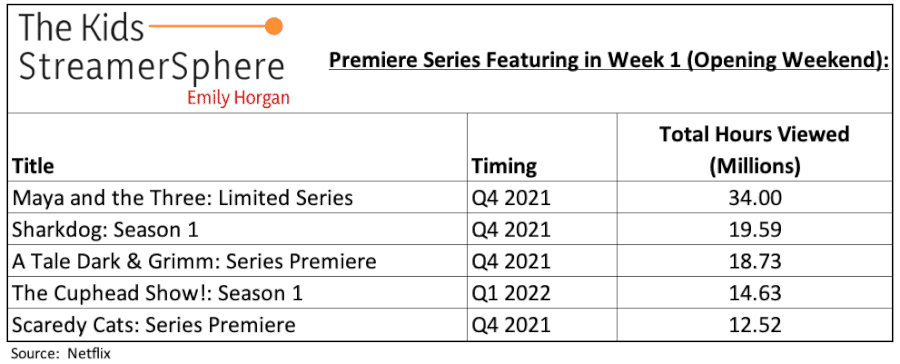

Although we don’t have comparisons for this across three weeks, below is how it stacks up against other kids shows across Week 1 and Week 1/2, though it was the only kids series to feature this quarter.

What’s very clear is that Maya and the Three remains the standout example of intersection between great animation and broad appeal. Series creator Jorge R. Gutierrez took to Twitter to confirm that he’s very much open for business at Netflix, despite the onslaught of headlines.

Yes. pic.twitter.com/kaONaQz0h4

— Jorge R. Gutierrez (@mexopolis) April 23, 2022

This was seconded, and indeed thirded, by other high profile showrunners including Chris Nee and Guillermo Del Toro.

Netflix Kids Movie Performance in Q1 2022

In movies, the live-action sequel Tall Girl 2 featured across three weeks, coming in reasonably strong with more than 27m hours viewed in its opening weekend. This beats The Princess Switch 3, which drove a seasonal 25m hours in the lead-up to Christmas.

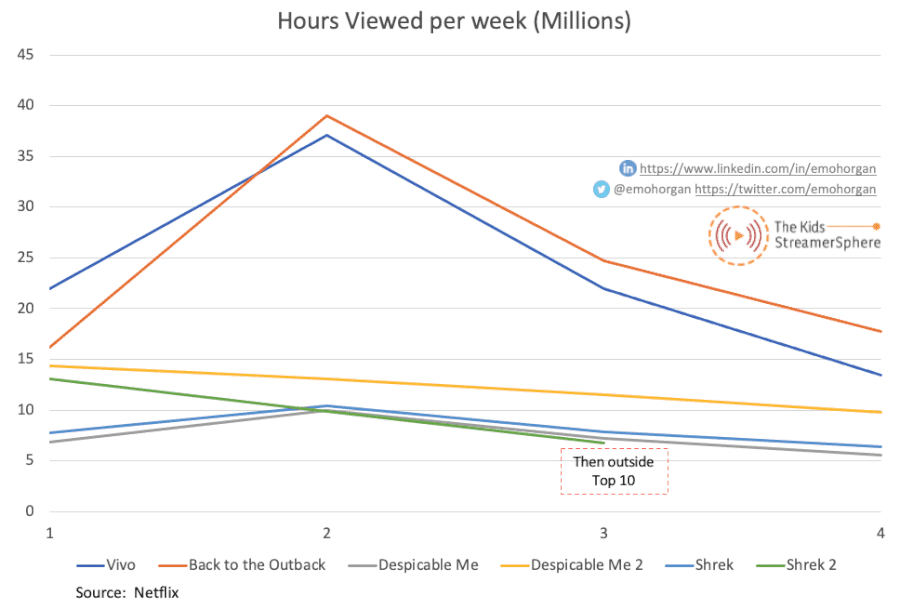

Another interesting thing we can see is licenses, presumably re-activating, across multiple films from NBCUniversal’s Illumination/DreamWorks franchises. Originals and sequels from Despicable Me and Shrek enjoy multi-week featuring. These films are probably in their seventh/eighth/ninth distribution windows depending on the market. They remain beloved by kids, and an important part of ongoing viewer success for streamers, as outlined in the previous installment of this newsletter. It’s understandable that they don’t hit quite as hot as marketed Netflix Original premieres Vivo and Back to the Outback. Their ability to chart on the Global Top 10 at all means that these old workhorses are beating out plenty of competition across all genres.

What does Netflix do next?

So, what does Netflix do now? It’s a question the entire industry is gagging to answer. The company’s relationship with NBCUniversal may have wobbled in recent years, but it seems to have stabilized at the right time. Licensing deals on franchise films are clearly flowing through the service. The series pipeline is also strong for both new, original concepts and derivatives. The Boss Baby: Back in the Crib, Kung Fu Panda: The Dragon Knight, and Gabby’s Dollhouse S5 are all ones to watch.

I guess the problem is, beyond DreamWorks, how many “true” in-house originals can really deliver ongoing audience engagement that is the key value for the kids audience? Is that what they’re even going for? Or is it binge-ability to rule them all? Here’s hoping not. If there is one thing we know over here in our little corner of kids media, going 4 quadrants ≠ applying the same approach four times.