Pictured: My Father’s Dragon, Sonic Prime and Wednesday

This is the latest entry of The Kids StreamerSphere, recapping the Q4 2022 Netflix quarterly results as it pertains to Netflix’s kid’s strategy.

The Kids StreamerSphere is a regular newsletter first published on LinkedIn, looking at the latest news, deals, and performance data for kids’ content within global streaming.

If you work in media, you’d have to live under a rock to have missed the key headline from the recent Netflix earnings call. Founder and co-CEO Reed Hastings announced his decision to step down. His horse’s mouth statement is here. There was some online banter that in-depth descriptions of the smooth succession process threw shade at core competitor Disney, but of course, I didn’t partake in that.

The baton is passed to Ted Sarandos, already in place in the role, alongside newly appointed Greg Peters. The former COO had been clearly gaining visibility in corporate comms over the past few months. With the streamer’s recent turbulence, there has been lots of snark about whether Hastings would pass his own notorious “keeper test.” Ultimately, he framed the move as being long in consideration and in process since Sarandos was upped to co-CEO in July 2020.

So how do you follow that with other key headlines?

I do my best.

Key Headlines:

A cascade of exec moves… Bela Bajaria took over Sarandos’ meager side hustle as CCO, and Scott Stuber went from “Head” to “Chairman” of Netflix Film.

Subscribers grew more than the abysmal forecast… Guidance from last quarter was a 4.6M increase, which would have been Netflix’s weakest Q4 since 2014. Ultimately it landed at +7.6M, with additions across all markets, notably EMEA up 3.2M. #ThankYouWednesday

Ad sales are crawling but in a good way… The advertising tier was launched just two months ago. So far, Netflix are seeing good engagement from users choosing this option, who are happy with the technical interface and experience. Also, the streamer is seeing fewer subscribers than it feared downgrade from premium. Netflix’s bottom line position on this is they’re crawling before they walk, let alone run. As a reminder, no ads are shown on Netflix in kids’ profiles.

Netflix Kids Q4 2022 Headlines

Picture: Netflix

Franchise and consumer products were discussed in relation to Wednesday’s Mac makeup palette, but it sounds like this was more of a hands-off back end for Netflix rather than anything they were driving for themselves. The impact of growing talent was also mentioned; however, Disney Channel folks among us would argue, “IT WASN’T JUST NETFLIX THAT BUILT JENNA ORTEGA AND SOFIA CARSON, TED!” Talent was a core focus of the Disney Channel under Gary Marsh. Just ask Zendaya.

Nuggets of content performance data seem to be less prevalent in earnings calls nowadays, probably because where before there was fish, there is now a fish pond in the form of the Netflix Global Hours Viewed Top 10 that the streamer releases weekly (abbreviated to NGHV Top 10 going forward for brevity—corporate habits die hard). If you’re comfortable with me being your, er, I guess, fishing rod, then read on, and I’ll tell you what I can, er, catch.

Netflix Q4 2022 Kids Content Performance

Kids Series Highlights

Tracking the performance of kids series on streaming is like pulling teeth, unless your name is CoComelon.

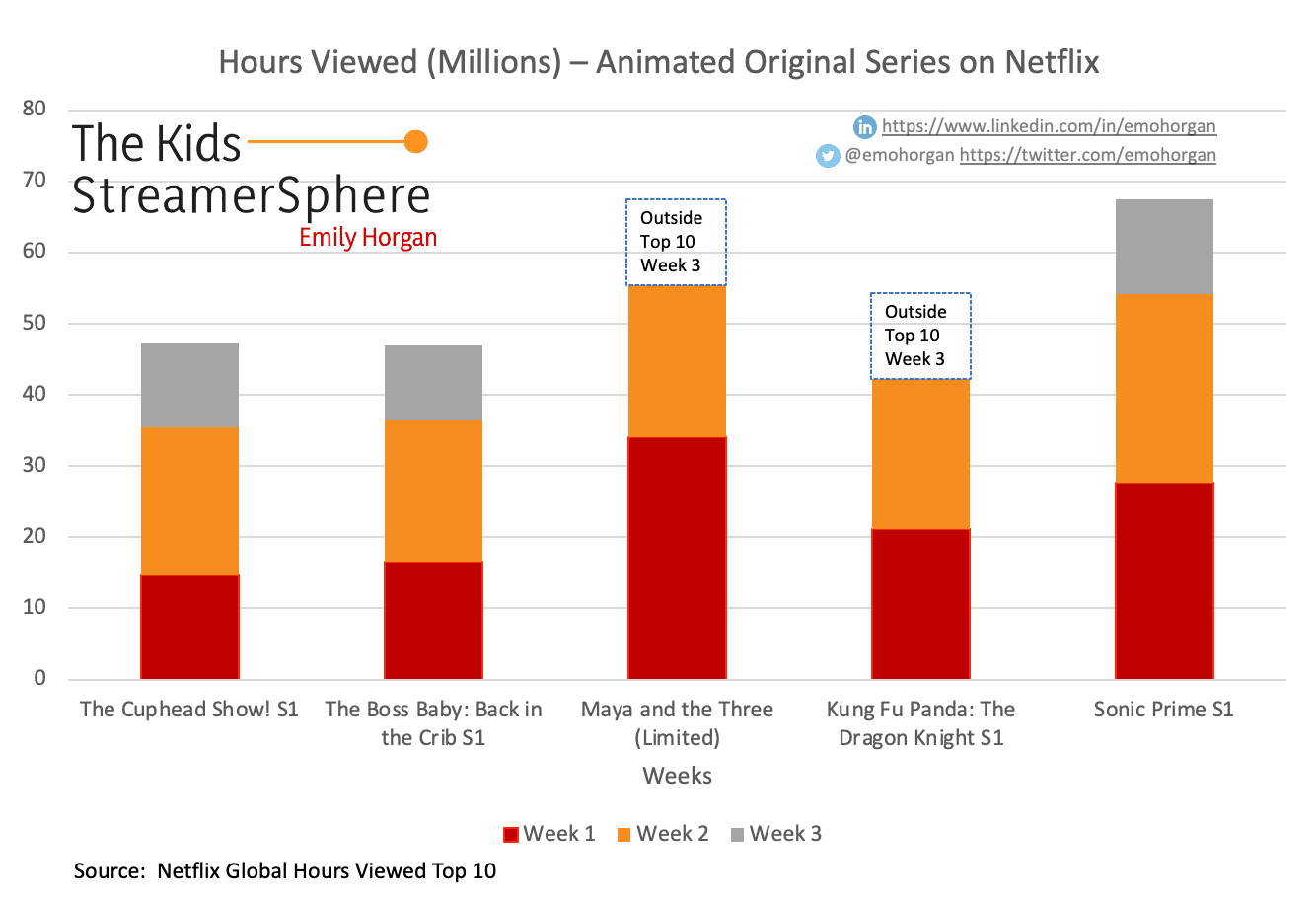

That’s why I was excited to see Sonic Prime set a new record for an animated series debut:

The spunky little hedgehog is having a hot year.

Sonic the Hedgehog 2 had the second highest animated box office of 2022, both domestically and internationally, coming behind Minions: The Rise of Gru. Whatever global rights Netflix had for Sonic 1 saw it linger in the NGHV Top 10 for eight weeks over the summer, presumably driven by marketing and interest in the sequel. The IP also sees good results on Roblox (h/t Jo Redfern).

Another series worth keeping an eye on is Little Angel. Moonbug Kids acquired this YouTube IP at the start of last year. It launched globally on Netflix in October and popped into the NGHV Top 10 across two weeks. In addition, it grabbed such excellent Trending Top 10 results that it rubbed shoulders with some high-performing shows in the annual kids roundup, despite only being around for the last quarter. I’ve extolled a bit more about this IP here and here. There’s sibling rivalry in the Moonbug household!

Kids Movies Highlights

Picture: Cartoon Saloon / Netflix

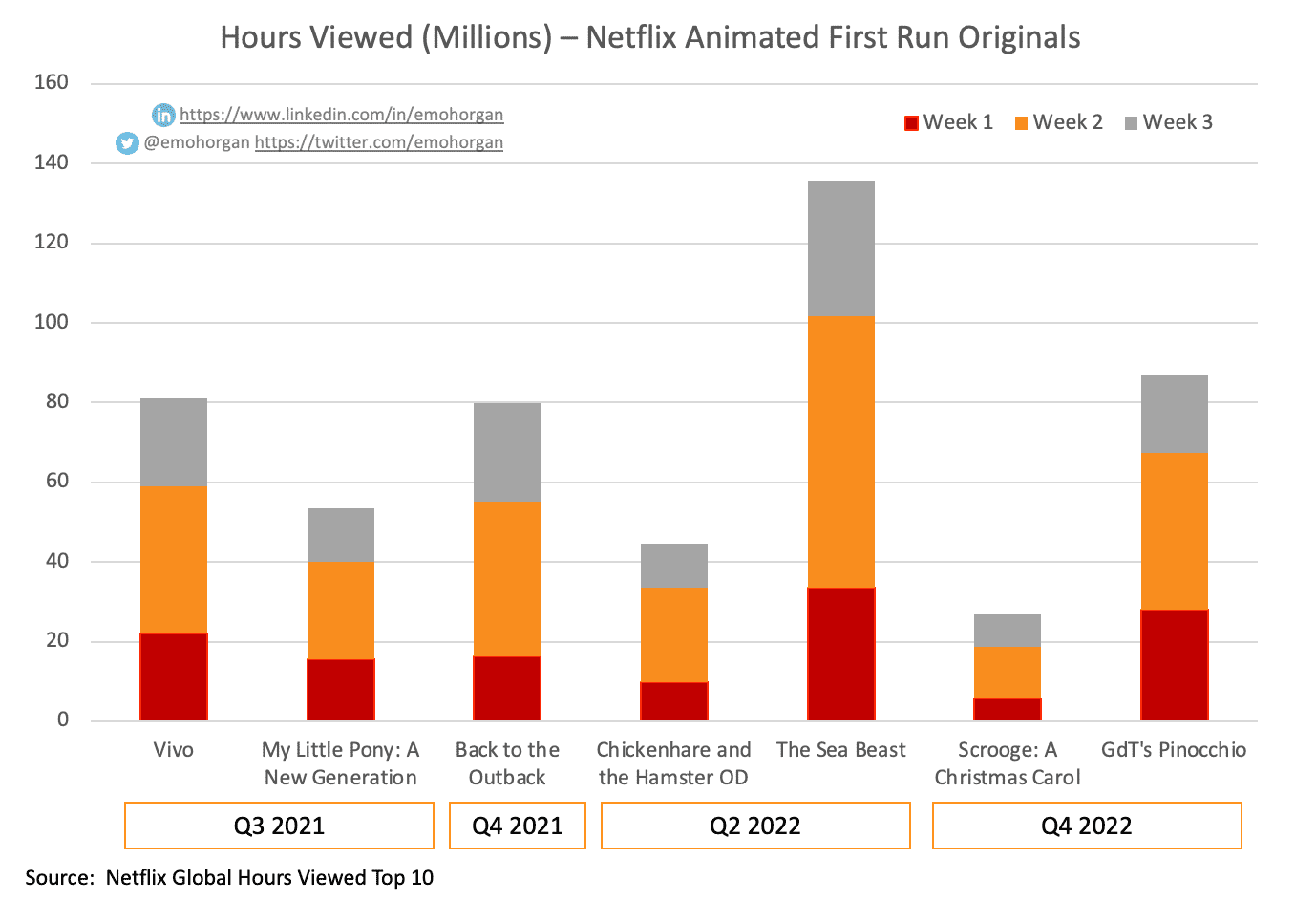

Moving onto animated movies, Q4 was CURSED, CURSED, I TELL YOU! Globally acquired/produced animated movies have had a certain bankability in featuring in the GHV Top 10 since its launch, without needing a high profile or serious marketing spend. I have never, and will never, pass up a chance to talk about the success of Chickenhare and the Hamster of Darkness, the little movie that could. That’s why it was so surprising that the start of the quarter saw two significant misses in this space. Wendell & Wild and My Father’s Dragon, two true Netflix Original movies, coming from Oscar-nominated animation creators, failed to break through. Wendell & Wild was door-jammed between a rock and a hard place. Its PG-13 rating kept it out of the kids section, and its appeal to adults is arguably niche. As for My Father’s Dragon… stop. My heart breaks.

Fittingly, I suppose, ’twas Scrooge, who eventually thawed the miserly freeze of the GHV Top 10 for animation. Netflix’s love affair with Christmas-themed commissioning shows no signs of slowing down, and the music-filled Dickens adaptation fitted right in. Here’s how it stacked up against other animated titles:

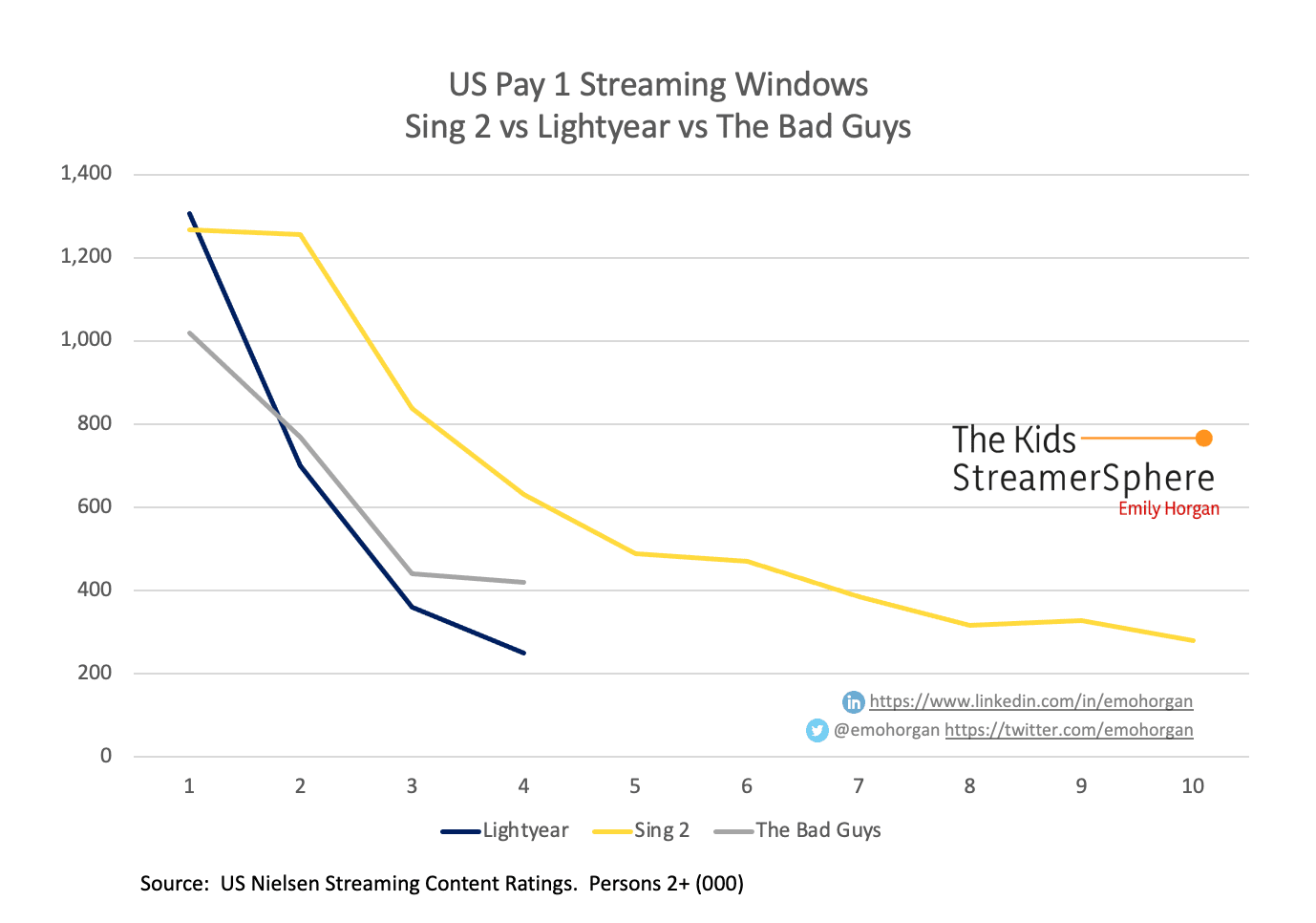

Elsewhere in animation, The Battle of Theatrical vs. Streaming waged on. Having debuted in cinemas last March, The Bad Guys hit its US Pay window on Netflix. It didn’t hit the heights or the longevity of Sing 2, but there’s no doubt that animated blockbusters do great streaming business. Here’s how the US Nielsen Streaming Content Ratings results stacked up, with a side order of Lightyear to lament as you see fit:

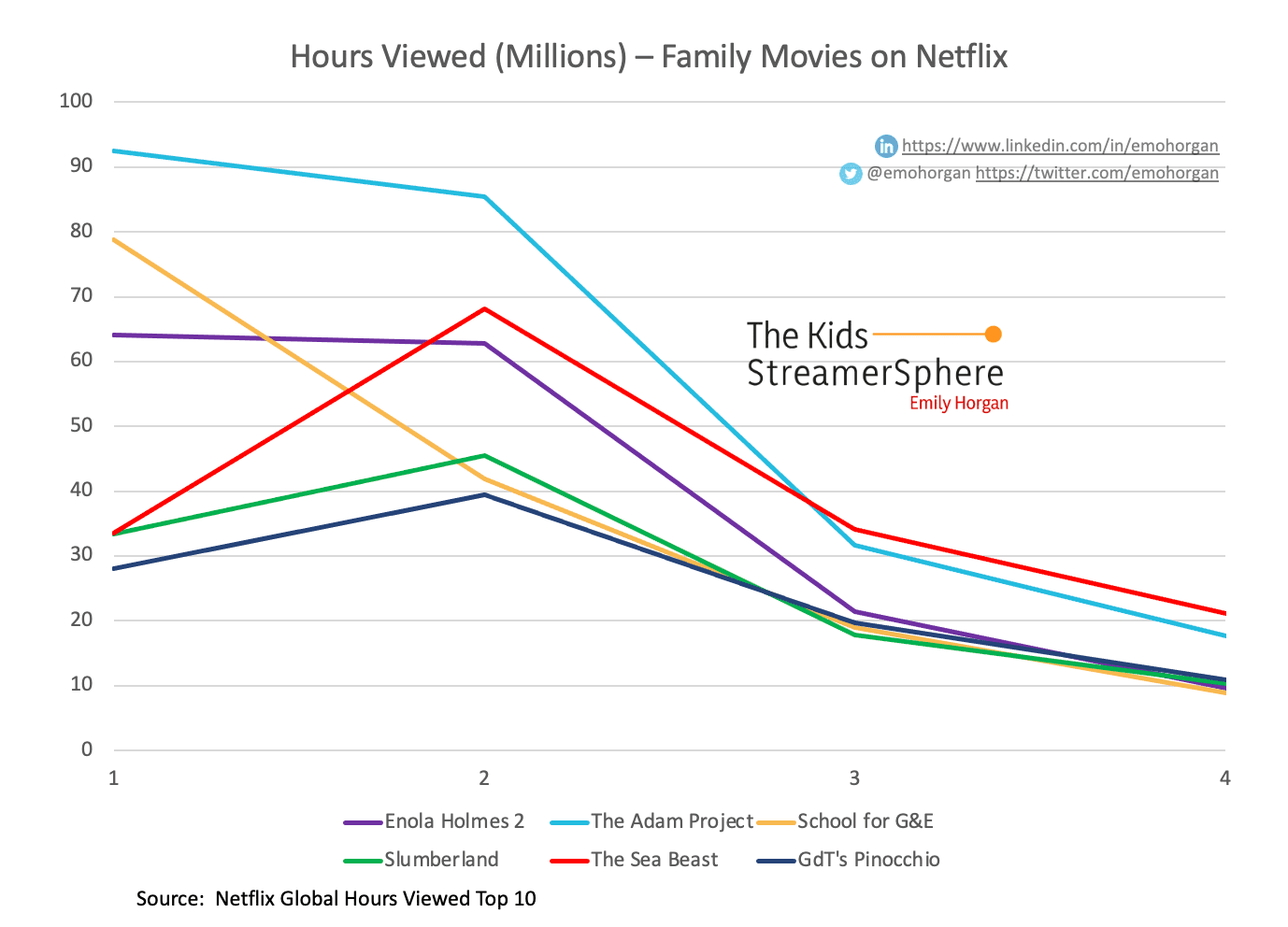

Moving on to live-action films, it feels like Netflix’s strategy here has evolved. It’s playing in the true family, sit-down, Saturday night space. The streamer speckles in movies are sure to have appeal for older kids, young teens, and up. This quarter saw Slumberland and The School for Good and Evil hit the kid’s section. These were both glossy (read $$$), and featured multiple A-list cast (more $$$).

Sitting just above this in terms of the demo was Enola Holmes 2, once again starring Stranger Things’ Millie Bobby Brown. The film’s debut elevated its prequel to the GHV Top 10; that’s the power of multi-installment IP. Like other recent Netflix films, including the runaway success The Adam Project, this has clear older kids/family appeal, with just enough edge to sit outside the kid’s section (which is seen as a plus if you’re 11). See below for the performance over four weeks, with animated movies included for scale:

The older kid/t(w)een/teen space is, for me, the most impressive part of Netflix’s content strategy for young people. They get that t(w)eens don’t want to be treated as kids, and provide content that fills this gap. That content has edge, just enough in my opinion, though others may disagree, which brings us to Wednesday.

The Wednesday series was heralded throughout the call as the standout success it clearly is. Across all metrics, there’s no doubting its impact. The show nails tone and appeal for this audience: school setting but a lead character with true quirk; fantastical vampires/werewolves/sirens but a spot-on soundtrack. I could go on. Across live-action content, this movies/series conveyor belt delivers young audiences up into the broader Netflix ecosystem of Stranger Things, Fate: The Winx Saga, The Umbrella Academy, Shadow and Bone, etc, etc, etc. Bravo!

What’s Next?

Picture: Netflix

As we wait to see what the world of Netflix looks like under Ted and Greg, there are several things to look forward to. TV Kids Global had a good writeup on upcoming kids content this week. The most interesting one for me comes on March 17th (Paddy’s Day for those who celebrate), when the animated original feature The Magician’s Elephant launches. What’s significant about this is that it’s the first output from animation studio Animal Logic since Netflix acquired it last year.

Despite wobbly comments towards the end of 2022 regarding their animated movie slate, Netflix now seems steady on what’s to come.

As already mentioned, a sequel was recently announced for The Sea Beast, alongside an overall deal with its creator, Chris Williams. They can also look forward to Leo, starring Adam Sandler in November. Add to this 2023 US Pay windows for Minions: The Rise of Gru and Puss in Boots: The Last Wish, and you have a party.

It’s younger-skewing Original series that doesn’t seem to be solved for the streamer, neither on live-action, nor animation. Perhaps the acquisition of tried and tested IP delivers enough? You can’t help but feel they’re missing the trick on a breakout show, easy and all as that is to write, hard and all as it is to do.