Emily Horgan, an independent media analyst is back with another rundown all of the big news from Netflix’s Q4 earnings call specifically as it pertains to Netflix kids and family. Below, you’ll get to see what’s been the big new kids hits for Netflix among other insights. A version of this post can also be found on LinkedIn.

The main headline being discussed from Netflix’s earnings call last week is a slowdown in growth, characterized by a miss on forecast subscriber additions. The company’s share price slipped by as much as 25% on Friday. Lucas Shaw at Bloomberg described it as their “worst day in a decade”. A bit of a blow, given the service launched their biggest content to date during the last quarter with Squid Game, plus movies Red Notice and Don’t Look Up. The growth reduction was put down to COVID-related tectonics alongside some impact from competition.

Local Focus

The evolution of the platform in global markets was also part of the conversation. India, where Netflix has recently reduced prices, has been a difficult nut to crack. The genesis of Brazil and Japan was also discussed. Household penetration of Netflix (outside of China) sits at around 25% worldwide, with some markets stronger than others.

Speaking of local markets, run-away Korean hit Squid Game was a hot topic. In addition to Korea, upcoming notable local productions will be coming out of Russia, LATAM, and the Nordics. The stated ideal is for:

“content that can be created anywhere and travel everywhere”

Of course, to make local content globally successful, you need to have great localization. Netflix spoke about how due consideration of subtitling and dubbing can enhance appeal to members. Interestingly, from a kid’s point of view, we can see some of this care and attention in the strong selection of Netflix original preschool shows that have been dubbed into British English. These include Ada Twist Scientist, Go, Dog. Go!, Mighty Express, Ridley Jones, and Trash Truck/Giant Jack.

Movies are Important

Ted Sarandos spoke at length about the cultural value of Netflix being home for movies:

“The idea that big-ticket movies that people really care about premiering and being part of your Netflix subscription is actually taking the value proposition to a new level”

“There’s a big theory, which is that people differently value movies because they always have to pay for it. You had to buy a movie ticket”

“Even if you really watch mostly television… we can service you on movie night”

“It’s much easier to watch a movie together than to make sure you’re all tracking on the same episode every week”

Upcoming movies referenced that will have family appeal include The Adam Project starring Ryan Reynolds and directed by Shawn Levy (Stranger Things), plus sequels Enola Holmes 2 and Tall Girl 2.

Franchise and Gaming

Finally, discussion about franchise extensions through gaming and consumer products was mainly directed at general entertainment IPs like Squid Game, Stranger Things, and Bridgerton. Netflix is “building those muscles steadily”. They see their current level being a 20% auxiliary boost of what it will be in the coming years.

Kids Movie Performance

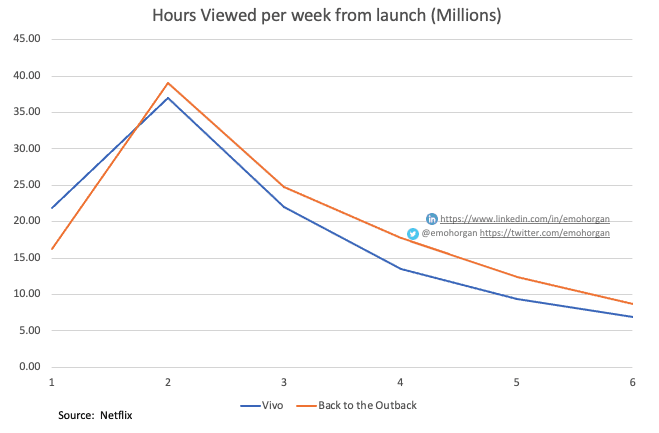

From a Kids Content performance point of view, the only name-check went to original animated feature, Back to the Outback. The film follows a group of dangerous Australian zoo animals. Sick of their bad reputation, they make the journey to return to the wild. By the new Netflix metric of “hours viewed”, the film clocked up 105m in its first 28 days. The change in metric means that we don’t have a comparison available that’s 100% tidy. We can now, however, look back at the global weekly data provided by Netflix and see how this measured out week to week.

Looking above, it’s conclusive that Back to the Outback beat out Vivo, the Sony produced animated musical with vocals and music from Lin Manuel Miranda. That’s an impressive achievement. The movie launched in the midst of Netflix’s annual kids Christmas content crunch, against a mountain of other titles. These included A Boy Called Christmas and The Princess Switch 3, whose premieres also both featured in the global numbers.

Kids Series Performance

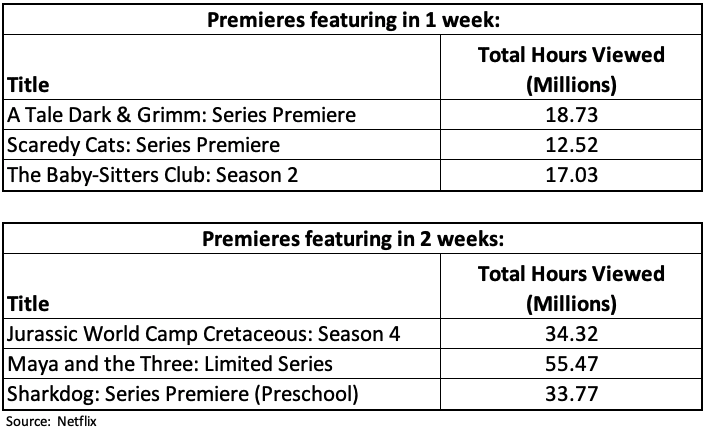

From a series point of view, Netflix’s global data tells us that the following originals had good uptake on premiere:

We’ll need to keep watching the data to define benchmarks but, on the face of it, limited series Maya and the Three seems to have had a good showing. It goes without saying that, as outlined previously, CoComelon continued to have the strongest showing in the global numbers of any kids show.

Other series scheduled for early/Spring 2022 include Bee and Puppycat: Lazy in Space Spring, Big Tree City, The Creature Cases, and Trico.

That’s it for now, my 2021 review is coming soon!