Picture – Getty Images

With acquisition and merger mania taking place in media right now, we welcome back The Entertainment Strategy Guy for a two-part series looking into if Netflix should jump into the action. This first entry will take a look at Netflix’s previous efforts in mergers and acquisitions and look into why they should make an acquisition. Part two, due out tomorrow, will dive into 9 suitable merger or acquisition targets.

Merger and acquisitions (M&A) speculation is the social media of business commentary; it isn’t very productive, but it’s still lots of fun.

Take the unending distraction of social media. Like Twitter. I should be writing an article—like this one—but instead, I’m debating strangers on the merits of the latest Netflix development deal and what it “means”. In other words, not very productive, but addictive as hell.

Speculating about M&A is often the same way. A truly great strategy is hard. It requires a visionary CEO to observe the competitive landscape, identify trends, and offer customers an excellent product that only their company can offer. That’s tough! Do you know what is even tougher? Trying to divine whether a company’s strategy is working. That requires lots of work and research and modeling. Tough!

You know what is easy? Guessing who should buy who. Or “M&A speculation”.

For all the failures of past M&A deals, the media—and Twitter!—love to speculate about mergers and acquisitions. Should Amazon buy CBS? Should Apple buy Disney? Or should Netflix buy, well, everyone?

And most of the time, all this speculation is for naught. Was anyone saying Disney would buy Fox? Not that I read. Was anyone saying that AT&T would sell Warner Media to Discovery? Again, not that I saw!

(Also in full disclosure, this article was written before the Discovery-AT&T news of the last week, but has been updated since.)

What is Truly Great M&A?

Let’s start with a definition of great strategy, which is itself a tough task. A great strategy means having a competitive advantage that is sustained by a company’s sources of strength. This ultimately results in delivering truly great products or services to customers.

If you want an example, think no further than Netflix this past decade. They’ve been relentlessly focused on offering an incredible streaming experience and they’ve been rewarded with a giant and devoted customer base. And they’ve largely done this without buying other companies.

What separates good mergers and acquisitions from bad ones? Well, if a company has a good strategy, then mergers and acquisitions should reinforce that (hopefully good) strategy. The exemplar in entertainment this last decade-plus was Disney. Before 2008, Disney was already the best-known brand in entertainment. But they were mainly known for Disneyland, Mickey Mouse, Princesses, and a few other things. To bolster these brands, they bought the best animation studio available in Pixar, a powerhouse of superhero IP in Marvel, and possibly the best franchise on the market in Star Wars. In essence, four of the “five pillars” of the Disney+ UX were all purchased in the last decade. Those were smart acquisitions.

SHANGHAI, CHINA – APRIL 08: Tourists watch a nighttime firework and light show at the Disney castle as Shanghai Disney Resort celebrates 5th birthday, on April 8, 2021 in Shanghai, China. (Photo by VCG/VCG via Getty Images)

Bad M&A tends to be like bad strategy: it doesn’t have a point. In other words, some firms simply buy other companies simply to get bigger to find “synergies” that don’t really exist. In the last decade, I’d point to Comcast buying NBC-Universal as a deal that didn’t really reinforce any of Comcast’s strategy, except to bulk up for bulking up’s sake.

However, deal-making has two parts: the value of the deal (reinforcing strategy) and the cost (the price you pay). A good purchase in M&A that isn’t at the right price can still be bad strategically. Devastating even. The best example in the last decade is AT&T, who likely overpaid for both DirecTV (which they wrote down and sold) and Time-Warner (who they just sold as well, for half the price.)

History: What Has Been Netflix’s Approach to M&A?

In two words:

Not much.

The reason why Netflix is such a good example of great, strike that, excellent strategy, is that they did it without wasting lots of effort on merging or acquiring competitors. Lots of other competitors in streaming cobbled together niche streamers or bought other entertainment companies. Netflix said, “Why buy that when we can build it?”

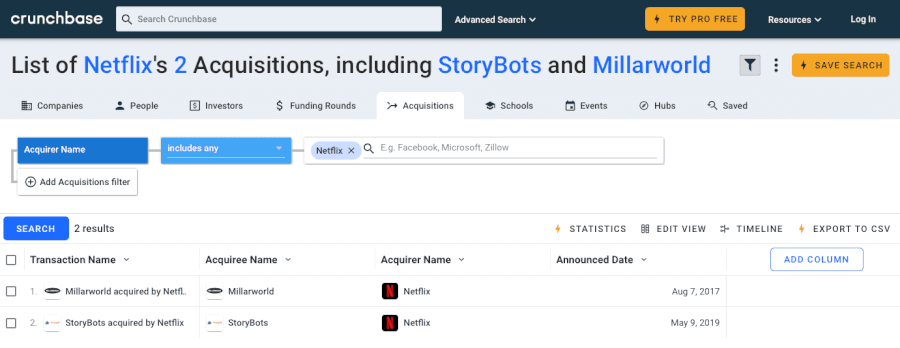

Seriously, here is their Crunchbase biography:

Meanwhile, other tech giants like Google or Amazon or Facebook have been on buying binges the last decade. Google bought a company per week in 2010 and 2011. Facebook has bought over 89 companies.

Netflix has bought only three companies. (And if I missed any others, they were likely so small as to not matter.) The highlights being…

- Millarworld – For an undisclosed price (rumored between $30-100 million), Netflix bought the comic book company owned by creator Mark Millar. Millar is the creator behind films such as Kick Ass and Wanted. This week, his first project for Netflix will come to the streamer—Jupiter’s Legacy—though his (arguably) most anticipated title—The Magic Order—has been in limbo.

- Storybots via Jibjab. Netflix wants to aggressively compete for kids programming, especially animated content. In 2019, Netflix purchased the Storybots brand from Jibjab, a maker of kids animated programming.

- Production facilities in New Mexico. Netflix also spent $30 million to buy production facilities in New Mexico in 2018. Recently, they announced plans to spend $1 billion on expanding their facilities.

While these deals are small, they still reinforce Netflix’s strategy. For the most part, Netflix wants to develop their own IP, but clearly they felt the need to buy both comic book IP and kids IP to speed up the process. Netflix is also a production juggernaut, so it was cheaper to buy a production studio in New Mexico than continuing to rent space.

Overall, though, you can’t take much from Netflix’s history because clearly their goal is to not purchase other companies, but to build organically.

How Much Can Netflix “Spend” on M&A?

The limiting factor on M&A is typically how much a company’s balance sheet can support buying other companies. Acquisitions aren’t free. Without diving too deep into the financial mechanics, a company can do this by offering either cash or stock price. The former is easy: you pay them the money. For the latter, this usually means offering a set number of shares for a given amount of the target company’s shares. If a company doesn’t have the cash on hand, and they usually don’t, they can also take on debt to buy other companies. (Again, look at AT&T this decade.)

Crucially, the amount a company pays is usually at a premium (meaning higher) than the current market value of a company. For privately traded companies, this is some multiple over the last funding round. For public companies, this is some percentage above the “market capitalization” of a firm at the price before the deal is announced.

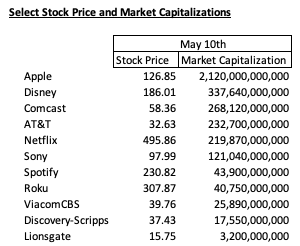

What is market capitalization? Well, that’s the price per share multiplied by the number of shares a company has issued (outstanding in industry parlance). To provide a few examples—which were current as of May 10th when I wrote this—here is Netflix and some other major streamers/entertainment companies:

For our purposes, I’m going to round some of these numbers. So for Netflix, you can say they are roughly an $225 billion sized firm. Given how their stock can move around, at any given moment, they are a $200-$250 billion company.

One last note. While it can seem like offering stock is a “free” way to acquire customers, it most definitely is not. When a firm issue new shares, they are diluting existing customers. A stock is a claim on some portion of a company’s future earnings. If you only had one share, a sole owner, they get all the future earnings. But if that hypothetical firm sold nine new shares, the first person only has claim to 10% of future earnings. They’ve been diluted by 90%. If Netflix “bought” a firm by issuing new shares that cost $50 billion, they’d dilute their current owners by 18%. (Roughly.)

The Antitrust Landscape

So I’ve said M&A can be either 1. Reinforcing good strategy or 2. Buying firms for buying’s sake. The former is good, the latter is bad strategy. We could add a third pillar:

- Buying competing firms to corner a market and decrease competition.

Arguably, this is potentially a “good” strategy, but it comes with such high costs for society that it’s worth calling out separately. Like other things that are bad for society, it’s illegal. And not just getting sued “civil” illegal, it is criminal. A company’s leadership could go to jail for breaking “antitrust” laws. (Though they hardly ever do anymore.)

Private equity firms, in particular, use M&A to roll up smaller industries in a move called “a roll up”. (Seriously check out salt consolidation in the American Midwest or consolidation in cheerleading.) It’s also the rationale driving Facebook and Google. Facebook bought WhatsApp and Instagram expressly so they couldn’t compete in social. Google purchased ad-word markets to increase its control of digital advertising. The government also alleges that Google and Facebook cooperated to control markets.

In all those cases, the goal isn’t really synergy, but size. With size comes better-negotiating power with suppliers and customers. I doubt Netflix could become this big in either production or distribution to warrant scrutiny from US or global antitrust regulators. That said, it increasingly looks like the EU, US and even Chinese regulators are cracking down on Big Tech mergers. Netflix is a part of Big Tech—they were in the FAANG acronym after all—so if Netflix went on a buying spree, they could come under the same monitoring as Google, Amazon, Apple and Facebook.

What Does Netflix Need in the 2020s?

How can M&A help Netflix reinforce its competitive advantage? Here are a few broad areas:

– Content. Netflix’s content spend right now is partially so high because they need to build a library from scratch. If they could buy a competitor or producer for less than the cost of building that library from scratch, that could help tremendously.

– Distribution. The next phase of the streaming wars may move from streamers to the distributors of streamers. Roku, Amazon, Apple, and even Comcast are vying to be the conduit for how you watch content. It may help Netflix to have a foothold in that world.

– Diversification. Right now, Netflix is the king of streaming video. But only “on-demand” video. They don’t have live TV, news, sports or a free model. Potentially, they could diversify their revenue streams to include live TV, advertising, or other business models.

To summarize: Netflix has historically ignored M&A, but in a few areas there are distinct opportunities if the price is right. Next time, we’ll speculate on those.

(The Entertainment Strategy Guy writes under this pseudonym at his eponymous website. A former exec at a streaming company, he prefers writing to sending emails/attending meetings, so he launched his own website. Sign up for his newsletter at Substack for regular thoughts and analysis on the business, strategy and economics of the media and entertainment industry.)